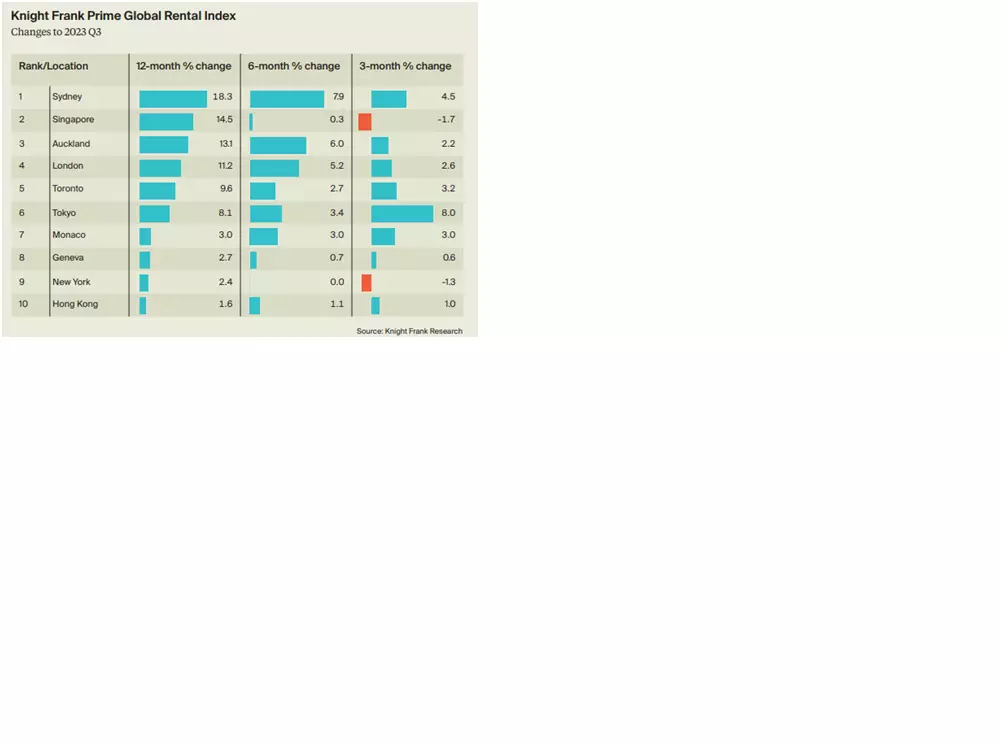

Global prime rents surge by 7.9% in Q3 2023

Average rental growth in the ten cities escalates three and a half times their long-run trend rate: Knight Frank’s Prime Global Rental Index

image for illustrative purpose

Hyderabad: The average rental growth in the ten global cities has escalated, exhibiting an upward trend that is three and a half times their long-run trend rate. Prime rents have surged to a level 17.9 per cent higher than their pre-pandemic peak in Q3 2019 according to Knight Frank's Prime Global Rental Index.

Despite ongoing debates surrounding work-from-home arrangements and the challenges in the office sector in key cities, the growth in the index confirms the underlying strength of demand for city living and the resilience of accommodation requirements from workers in proximity to Central Business Districts (CBDs).

Sydney is the top-ranked city on Prime Global Rental Index, whose annual growth went from 13.1 per cent reported in Q2 2023 to 18.3 per cent in Q3 2023. Singapore and New York experienced a quarterly dip in rent; however rental trends for both the markets remain strong annually. The rise in annual growth had fair share of contribution from Auckland which has shown a jump from 7.2 per cent in Q2 to 13.1 per cent in Q3. Annual rental growth in Prime Central London stands at 11.2 per cent, indicating a cooling trend in demand and supply re-balance.

Liam Bailey, Knight Frank’s global head of research, said, “While prime global rents continue to climb, with the Prime Global Rental Index strengthening to 7.9 per cent year-on-year in September, slower growth in markets like New York and Singapore points to the likely direction of travel for big city markets - where, despite strong demand and weak supply, we are approaching affordability limits.”